Are you starting a business or thinking about changing your payment processing provider? You’ve probably heard of Stripe and Square, two of the most popular options on the market. But which one is right for your business?

The ability to accept payments online is increasingly important in today’s digital economy. With the growth of e-commerce and m-commerce, there has been an increased need for secure and convenient payment processing services.

Stripe is a payment processing company that started in 2010 and is located in San Francisco. Their payment processing services are for internet businesses, with an emphasis on e-commerce operations.

On the other hand, Square was established in 2009 and has its headquarters in the same Californian city. The company specializes in providing payment processing services to small companies, both online and offline.

In this blog post, we’ll dive into the similarities and differences between Stripe and Square, and help you figure out which one is the better fit for you.

Contents

ToggleStripe vs. Square: Features

When it comes to payment processing, both Stripe and Square offer a variety of features that make them appealing options for businesses of all sizes.

Let’s take a closer look at what each platform has to offer.

Stripe’s Features

Subscription and recurring billing

Stripe provides a flexible and customizable subscription billing system, allowing merchants to set up recurring payments for their products or services.

This feature enables businesses to manage their cash flow more effectively by automating the billing process and ensuring timely payments. Stripe also offers features like metered billing and trial periods, allowing businesses to create unique subscription plans that suit their needs.

Invoicing and billing

Stripe offers a simple and intuitive invoicing system that allows businesses to create, send, and manage invoices. This feature allows merchants to bill their customers for one-time purchases, custom orders, or services rendered.

Businesses can also create payment schedules and automate payment reminders, reducing the time and effort required to manage billing and collections.

Fraud detection and prevention

Stripe uses machine learning algorithms and real-time data analysis to detect and prevent fraud. This feature enables businesses to minimize the risk of fraudulent transactions and protect themselves from chargebacks and other financial losses.

Stripe also offers customizable fraud rules, allowing merchants to set their own risk thresholds and adjust their fraud detection settings according to their business needs.

Global payment processing

Stripe supports payment processing in more than 135 currencies and 30 countries, making it easy for businesses to accept payments from customers around the world. This feature includes support for international credit cards, local payment methods, and currency conversion.

Stripe also offers localized payment pages, allowing businesses to provide a seamless payment experience for their customers regardless of their location.

Square’s features

Point-of-sale (POS) systems

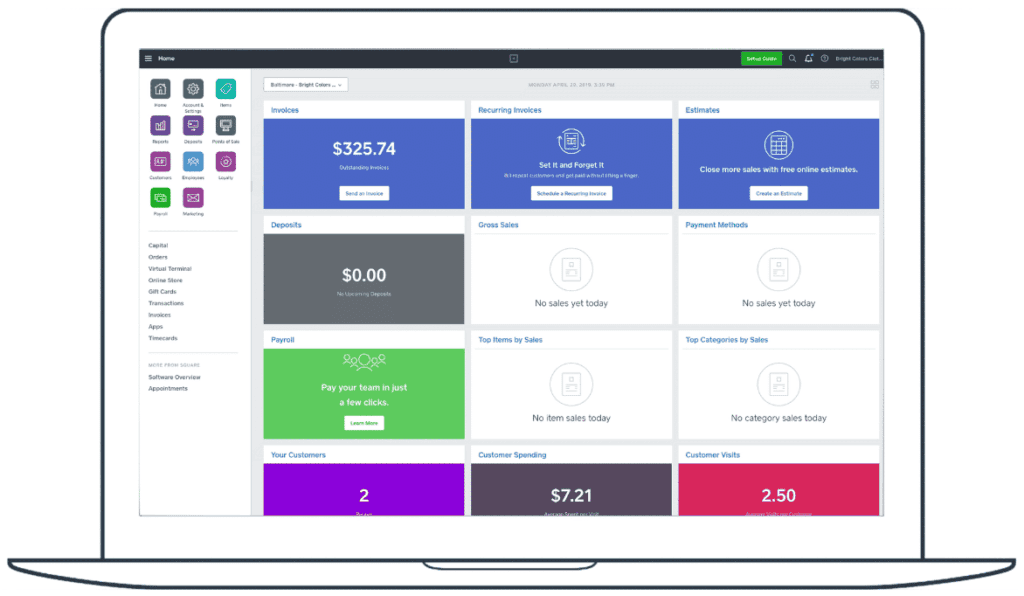

Square provides a range of POS systems that enable businesses to accept payments from customers in-store, online, or on the go. Square’s POS systems include features like inventory management, sales analytics, and customizable receipts, allowing businesses to track their sales and manage their operations more effectively.

Inventory management

Square offers an inventory management system that enables businesses to track their inventory levels, set reorder points, and receive alerts when inventory levels are low. This feature allows businesses to manage their stock more efficiently, reduce waste, and avoid stockouts.

Team member management

Square provides a team member management system that enables businesses to manage their team member schedules, track team member time, and process payroll. This feature allows businesses to streamline their HR processes and ensure compliance with labor laws.

Stripe vs. Square: Payment Processing Fees and Pricing

When it comes to payment processing, both Stripe and Square offer a variety of features that make them appealing options for businesses of all sizes. Let’s take a closer look at what each platform has to offer.

First, let’s talk about payment processing features. Stripe and Square both accept a variety of payment methods, including credit and debit cards, ACH transfers, and even cryptocurrencies like Bitcoin.

However, when it comes to fees, Stripe and Square differ slightly.

Stripe charges a flat fee of 2.9% + 30 cents per transaction, regardless of the type of payment method used.

Square, on the other hand, charges a slightly higher fee of 2.6% + 10 cents per transaction for payments made via its virtual terminal, but a lower fee of 2.9% + 30 cents per transaction for payments made through its mobile app or card reader.

In terms of payment processing time, both Stripe and Square offer fast deposits, with funds typically appearing in your account within 1-2 business days.

However, Stripe offers next-day payouts for a small additional fee, which can be helpful for businesses that need to access their funds quickly.

Stripe vs. Square: Security and Fraud Prevention Measures

Security and fraud prevention are essential when it comes to online payments. Both Stripe and Square offer advanced security features, including:

Encryption of sensitive data

Both Stripe and Square use industry-standard encryption protocols to protect sensitive data during transmission and storage. This means that when customers enter their payment information on a website or mobile app, the data is encrypted so that it cannot be intercepted or accessed by unauthorized parties. This helps prevent data breaches and theft of sensitive information.

Two-factor authentication

Both Stripe and Square offer two-factor authentication (2FA) to add an extra layer of security to user accounts. This requires users to provide a second form of authentication, such as a code sent to their phone or email, in addition to their username and password. This helps prevent unauthorized access to user accounts, even if a password is compromised.

Related: 10 Best WordPress Malware & Security Scanners

Fraud detection and prevention

Both Stripe and Square use sophisticated algorithms to detect and prevent fraudulent transactions. They analyze patterns of behavior and can identify suspicious transactions, such as multiple transactions from a single IP address or unusual purchase amounts. This helps protect merchants from chargebacks and other fraudulent activities.

Chargeback protection

Chargebacks occur when customers dispute a charge on their credit card statement. This can happen for a variety of reasons, such as a fraudulent charge or a product or service that was not delivered as promised. Both Stripe and Square offer chargeback protection to help merchants avoid financial losses due to chargebacks. They provide tools to help merchants dispute chargebacks and protect against fraudulent claims.

Stripe vs Square: Ease of Use

When it comes to ease of use, Stripe and Square both offer user-friendly interfaces and straightforward account setup processes. However, there are some differences to consider.

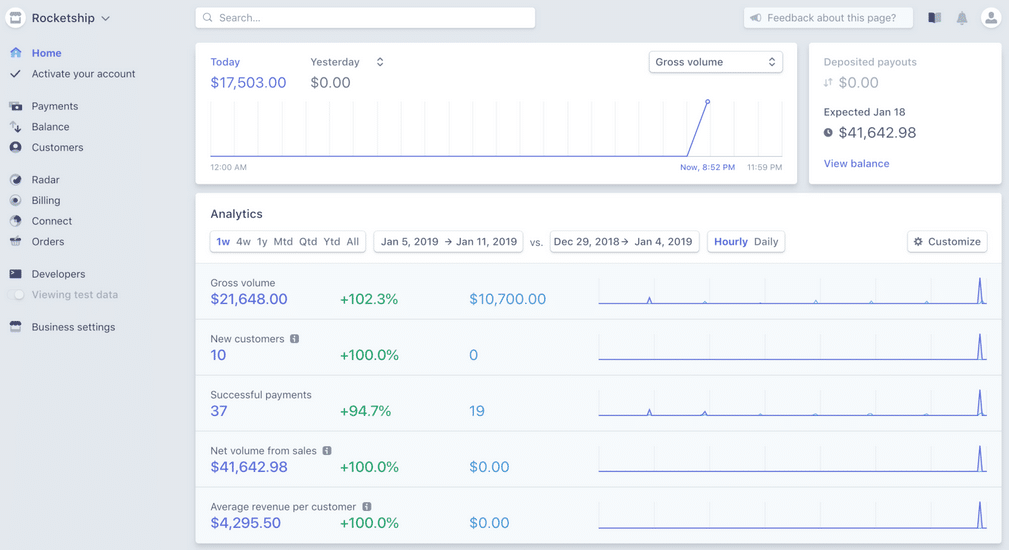

Let’s start with the user interface. Both Stripe and Square have intuitive dashboards that allow you to manage your payments and view transaction history. However, some users find Stripe’s dashboard to be a bit more complex than Square’s, which can make it more challenging for beginners.

When it comes to account setup, both platforms make it easy to sign up and get started. Stripe’s setup process involves filling out a form with your business and payment information and verifying your bank account. Square’s setup process is similar but may require a bit more information, like your Social Security number.

The mobile app functionality is another area where Stripe and Square differ slightly. Stripe does have a mobile app, but it’s primarily geared toward developers and isn’t as user-friendly as Square’s mobile app. Square’s app is designed to be easy to use, with features like in-person payments and easy refunds.

Read More: What Is Application Performance Monitoring?

Overall, both Stripe and Square are relatively easy to use, but the differences in the user interface, account setup, and mobile app functionality may make one platform more appealing than the other.

If you’re looking for a payment processor that’s easy to set up and use right out of the box, Square might be the better option. If you need more advanced features and integrations, Stripe might be the way to go.

Stripe vs. Square: Integrations and Compatibility

Integrations and compatibility with other software and platforms are crucial for businesses that use multiple tools to manage their operations.

Stripe and Square both offer integrations with a variety of popular software and platforms, including:

E-commerce platforms

Starting with Stripe, it offers a range of plugins and integrations for popular e-commerce platforms, including Shopify, Magento, WooCommerce, and more. In particular, Stripe’s integration with WooCommerce, a popular WordPress e-commerce plugin, is seamless and user-friendly.

Learn More: How To Migrate From Shopify to WooCommerce?

WooCommerce users can easily integrate Stripe as their payment processor and accept payments directly on their website. Stripe also offers a comprehensive API that allows businesses to build custom integrations with their e-commerce platform of choice.

Moving on to Square, it also offers a range of integrations with popular e-commerce platforms, including WooCommerce, Shopify, and Magento. However, Square’s integration with WooCommerce is not as seamless as Stripe’s.

Square requires users to set up a separate Square account and install a plugin to integrate with WooCommerce. While this process is relatively straightforward, it can be a bit more time-consuming than Stripe’s integration.

When it comes to WordPress/WooCommerce specifically, Stripe may be the better option for businesses that want a more streamlined integration process. However, Square’s integration with WooCommerce is still a viable option for businesses that prefer Square’s pricing structure or hardware options.

Accounting software

Stripe and Square also offer integrations with accounting software like QuickBooks and Xero. This integration helps merchants to reconcile their payments with their accounting records, track revenue, and expenses, and generate financial reports. This saves time and reduces the likelihood of manual errors in accounting.

Inventory management software

Square offers an inventory management software called Square Inventory, which integrates with the Square payment system. This integration allows merchants to manage their inventory levels, track sales, and receive alerts when inventory levels are low.

Stripe offers integration with Stitch Labs, which is an inventory management software that integrates with various sales channels, including Stripe.

Conclusion

Both Stripe and Square are very functional and versatile payment processing options. While Square’s suite of payment processing and point-of-sale services is more suited to local businesses, Stripe is better suited to internet firms that require worldwide payment processing.

Ultimately, the choice between the two platforms will depend on your specific business needs, including the volume of transactions you process, the level of customization you require, and the features you need to run your business efficiently.

If you’re looking for a reliable WooCommerce development service to help you integrate Stripe, Square, or any other payment processor with your e-commerce platform, Seahawk is here to help. Our team of experienced developers can help you optimize your online store and streamline your payment processing, so you can focus on growing your business.

Contact us today to learn more about our WooCommerce development services and how we can help take your e-commerce store to the next level.

Frequently Asked Questions (FAQs)

Stripe and Square are both payment processing companies that allow businesses to accept credit and debit card payments online and in person.

While both companies offer similar services, they have some key differences. Stripe focuses primarily on online payment processing, while Square offers a wider range of payment solutions, including point-of-sale hardware and software.

Stripe is generally considered to be the better option for online payments because it has a more robust set of features for e-commerce businesses.

Square is typically the better choice for in-person payments because it offers a range of hardware options for businesses that need to accept payments in a physical location.

Stripe and Square have similar fee structures, with both companies charging 2.9% + 30 cents per transaction for online payments. However, Square offers lower fees for in-person transactions when using their hardware, charging 2.6% + 10 cents per transaction.

Yes, it is possible to use both Stripe and Square for payment processing. Some businesses may find that using both services can help them cover all their payment processing needs.

The choice between Stripe and Square ultimately depends on your business’s specific needs. If you primarily sell online, Stripe may be the better choice, while businesses that need to accept in-person payments may prefer Square.